Stop Wasting Money: The 50/30/20 Rule

Managing your money shouldn’t feel confusing or overwhelming. Yet, many people struggle

because they don’t have a simple system to follow. That’s where the 50/30/20 rule comes in, a

proven budgeting framework that helps you take control of your finances, save more, and invest

for the future with confidence.

This approach isn’t just theoretical. It’s grounded in real financial practices and used by

successful individuals around the world. In Nigeria, leaders like Femi Otedola have shown that

disciplined financial habits matter more than luck. His book, Making It Big, highlights how

consistent money management played a key role in his financial journey.

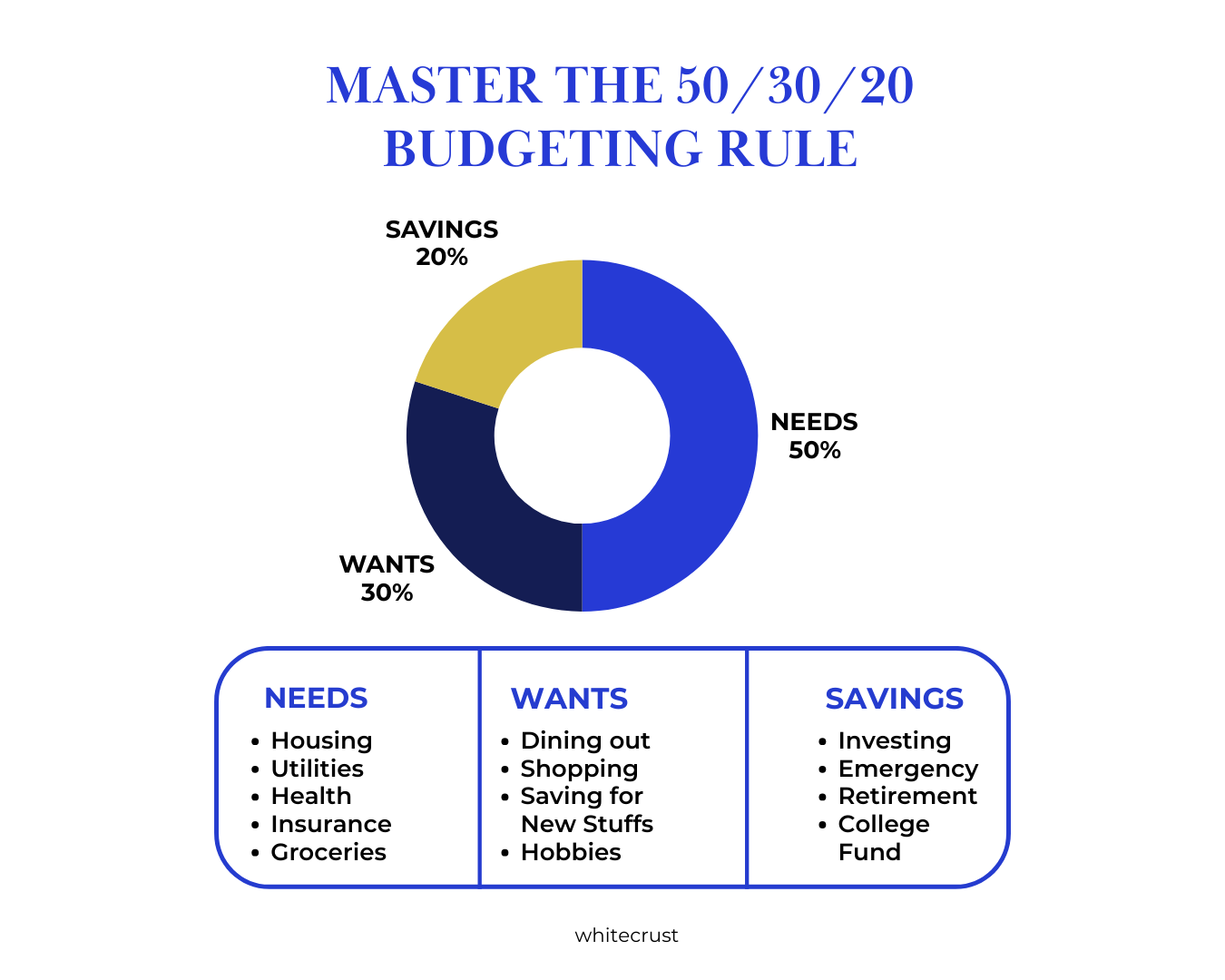

What Is the 50/30/20 Rule?

The 50/30/20 rule divides your take‑home income into three practical categories:

1. 50% for Essentials

- Essentials are the foundational costs of living. This includes:

- Rent or mortgage

- Food and groceries

- Transport and fuel

- Utilities (electricity, water, internet)

Keeping these costs within half of your income ensures that you meet your basic needs without

overspending. When essentials are controlled, you create breathing room in your budget and

reduce financial stress.

2. 30% for Lifestyle Spending

This portion is for anything you choose to spend on that isn’t a necessity. It includes:

- Dining out and entertainment

- Subscriptions and leisure activities

- Travel and personal hobbies

The key here is balance. You should enjoy your earnings, but not at the expense of your

long‑term plans. Spending wisely in this category allows you to live comfortably without

derailing your financial goals.

3. 20% for Savings and Investments

This is the most powerful part of the rule. When you consistently allocate 20% of your income

toward savings and investments, you build:

- Emergency funds

- Retirement savings

- Investment portfolios

- Future opportunities like business or real estate

Even modest contributions can grow significantly over time. That’s the magic of consistency and

compound growth.

Why It Works

The 50/30/20 rule succeeds because it is:

- Simple to understand

- Easy to implement

- Flexible enough for different income levels and lifestyles

Rather than guessing where your money goes each month, this rule gives you a clear roadmap.

You track less and plan more.

How to Start Using the 50/30/20 Rule

-

Calculate Your Net Income

Determine your monthly income after taxes and deductions. -

Track Current Spending

Monitor your expenses for one month to see where your money goes. -

Allocate by the 50/30/20 Rule

Adjust your budget so 50% covers essentials, 30% lifestyle, and 20% savings and

investments. -

Review Regularly

Revisit your budget each month and adjust as needed.

Small changes today lead to stronger financial health tomorrow.

Start Your Financial Growth Journey with Whitecrust Investment.

At Whitecrust Investment, we help everyday earners turn intentional habits into long‑term

financial strength. The best time to start is now. Visit our website for tools, guides, and expert

support that make saving and investing simple.

Learn more at:https://whitecrust.co/